by Hardwick Legal | Jun 2, 2015 | Purpose Built (LexisNexis)

What must landlords of statutory periodic tenancies that arose after 6 April 2007 do to comply with the tenancy deposit legislation?

The Deregulation Act 2015 (DA 2015) deals with an issue of concern that arose in Superstrike Ltd v Rodrigues [2013] All ER (D) 135 (Jun). One of the outcomes of the case was that landlords who had taken tenancies prior to the tenancy deposit legislation coming into force in April 2007 – where the tenancies had subsequently become statutory periodic tenancies - were required to protect deposits and serve prescribed information on the tenancies becoming statutory periodic. DA 2015 provides a window of time for such landlord to comply if they have not already done so.

What must landlords do next?

Any landlord who took a deposit before 6 April 2007 must protect it and serve the required information on a tenant within 90 days from the Royal Assent of DA 2015 on 26 March 2015 (or, if earlier, before the first day after the commencement date on which a court determines an application or decides an appeal under the Housing Act 2004, s 214 or the Housing Act 1988, s 21).

Assuming there are no court determinations, this would appear to make the deadline 24 June 2015, but landlords would be well-advised to take action now to avoid any hair-splitting arguments as to the exact time for compliance.

If that is done then it will be as if the deposit had always been protected and the prescribed information served.

Source: LexisNexis Purpose Built

by Hardwick Legal | Jun 1, 2015 | Purpose Built (LexisNexis)

John Lovell of Lovell Consulting , interviewed by Melissa Moore of LexisPSL Property, reflects on how changes to the Finance Act in April 2014 have affected real estate transactions.

Why are capital allowances important to property clients and their lawyers?

- Businesses are overlooking millions of pounds worth of tax allowances. Commercial property owners may be failing to claim due to embedded plant fixtures not being separately valued.

- Until a survey of the property is carried out by a capital allowances specialist qualifying items will remain unclaimed.

- Changes to the Finance Act from April 2014 now mean that these tax allowances could be permanently lost to a new buyer and all future owners.

- April 2014 saw the introduction of the new “pooling requirement”.

- For transactions after this date where the seller could have claimed allowances: (i) the buyer is required to fix the value of allowances to be passed on from the seller; and (ii) the seller is required to pool the allowances in their tax return. If these two requirements are not met within 2 years of the transaction’s completion date the buyer and all subsequent owners forfeit their entitlement to capital allowances forever.

- Overlooking these new legislative requirements risks not just lost tax savings but also a loss of value to pass on when the property is sold. Capital allowances are often an effective carrot in marketing a property.

- As a result, property lawyers overlooking capital allowances face higher risks of PII claims.

Take for example a non-resident property investment company purchasing a property for £20m with potential capital allowances of £4m made up as follows:

|

Total allowances |

Written down allowance (WDA) |

Notes |

| Integral features |

2,500,000 |

8% |

Depreciate at 8% on reducing balance |

| Pooled plant |

1,500,000 |

18% |

Depreciate at 18% on reducing balance |

| Total allowances |

4,000,000 |

|

|

|

|

|

|

Using the capital allowances could nearly halve the tax bill in year 1 leading to a much better yield. If the Annual Investment Allowance has not been utilized it may be possible to accelerate the allowances. Currently the first £500,000 is available as an AIA, depending on the year end and when the expenditure is incurred.

|

NO DEBT AND NO CAPITAL ALLOWANCES OPTION 1 |

NO DEBT WITH CAPITAL ALLOWANCES OPTION 2 |

| Rental Income |

£1.0m |

£1.0m |

| Less Capital Allowance |

(0) |

(£0.47m) |

| Taxable Profits |

£1.0m |

£0.53m |

| Tax Due Year 1 |

|

|

| UK Personal Tax x 45% |

£450,000 |

£238,500 |

| UK Company Tax x 21% |

£210,000 |

£111,300 |

| Non-res landlord x 20% |

£200,000 |

£106,000 |

|

|

|

|

|

|

| Net |

£140,000 |

£544,200 |

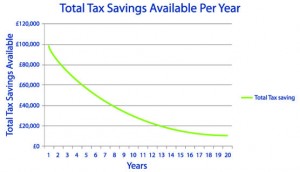

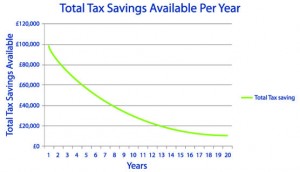

Chart:

Total tax savings on a simple example per £100,000 over the written down period of 20 years could be significant:

In what circumstances might a client be entitled to claim Capital Allowances?

Client profile: individuals, companies, partnerships or overseas investors can claim capital allowances, provided they are chargeable to UK tax i.e. not charitable, pension funds etc.

The Property: subject only to limited exceptions (including furnished holiday lets (FHLs); communal areas to apartment blocks; and student accommodation) the property must be a commercial property.

The Ownership Intention: the client must hold the property as an investment i.e. the relief is not available to developers (except land remediation relief)

Contaminated Land Relief: applies to commercial land held for investment purposes but can also be claimed by property developers and for residential developments.

Typical Levels of Allowance by Property Type

The available allowances will differ between different types of property. For instance, hotels typically have significant plant and equipment and hence the level of allowances is likely to be higher.

Typical rates of allowance (expressed as a percentage of purchase price) for various types of property are set out in the table below. The value of allowances will depend on any previous claims made by a former owner and any tax elections which may reduce the quantum.

| Type of property |

Example Purchase Price |

Typical Allowances |

Tax Saving Over Time |

|

|

% |

£ |

Non Res Co (20%) |

| Hotel |

£30m |

40% |

£12m |

£2,400,000 |

| Office |

£10m |

30% |

£3m |

£600,000 |

| Industrial |

£5m |

10% |

£0.5m |

£100,000 |

| Retail |

£15m |

5% |

£0.75m |

£150,000 |

What items are available for allowances?

General Pool (18% wda)

Sanitary fittings; Fittings, furniture and equipment; Carpet tiles; Fire alarm; Telephone and computer system; Demountable Partitions; Sprinklers; Swimming Pools.

Special Rate Pool (8% wda)

Lifts, escalators and moving walkways, hot water systems, heating, air conditioning and ventilation systems.

Also (since introduction of wider definition in 2008): Electrical lighting and power systems, cold water systems, external solar shading, thermal insulation to an existing building.

100% Enhanced Capital Allowances

Introduced by Finance Act 2001

Energy Technologies – April 2001

Water Technologies – April 2003

Only specific products included on the ECA list qualify. See government websites: etl.decc.gov.uk and wtl.defra.gov.uk

Contaminated Land – 150% tax relief

Including Japanese knotweed, asbestos and services diversions.

Wider definition if land is classified as derelict.

Only available to UK Limited companies.

Available to both developers and investors.

What should property lawyers be doing?

The law society Practical Guidance on capital allowances is a good guide to follow for best practice and stresses that whether you are acting for the seller or purchaser, you should raise the issue of CAs with your client as early as possible. If you are unsure about how to go about this, just as you would advise your client to carry out a survey or obtain insurance advice, you should consult a specialist CA adviser, or suggest your client consults one directly.

Acting for the Seller

- Highlight the value available to the buyer which can be a useful bargaining tool, particularly if it offsets less desirable aspects of the deal.

- If your client is a taxpayer but hasn’t claimed or pooled, you should make sure they pool prior to sale - assuming your client wishes to pass on the allowances - and if your client wishes to enter into a section 198 or section 199 election to fix the value of allowances, actually claim the allowances prior to sale.

- If your client hasn’t claimed, and is a non-taxpayer, then a written statement to that effect should be provided to the purchaser, or section 198 elections entered into by the last seller to have claimed allowances.

- If you are uncertain about any of this, you should advise your client to contact their accountant or a specialist CA adviser to provide the answers to the pre-contract enquiries Commercial Property Standard Enquiry 32 now requires the seller to provide detailed information on capital allowances and incomplete or ambiguous information about expenditure on fixtures will likely be rejected by the purchaser.

- Finally, you should include a section 198 election or written statement in the contract and supporting documentation. Not doing this could result in a loss for your client and could even amount to a breach of contract.

Acting for the Buyer

- For the buyer the tax savings can mean an immediate cash flow benefit and in some cases can make a marginal deal work.

- Raise the issue of CAs early - certainly before acquisition, as failure to raise the issue until after acquisition could mean that the CAs are lost to your client. As always, if in doubt, you should consult, or suggest your client consults, a specialist.

- Regardless of whether your client is a taxpayer, CAs can be important - by ensuring pooling by the seller, non-taxpayer purchasers can preserve the CAs value in case of a future sale. You should always bring this issue to your client’s attention and ensure that requests are made for the seller to provide the relevant documentation, pre-acquisition.

- If your client is a taxpayer, then provisions should also be included in heads of terms to be negotiated.

My client has an accountant- should they also consider seeking advice from a Capital Allowance specialist?

Accountants and their advisors may of course be aware of and handle any capital allowances claim as part of routine tax compliance. However, retaining a specialist may provide your client with further comfort that the full extent of qualifying expenditure has been picked up. There can also be differences between an accountant’s approach to claiming allowances (typically a desktop invoice review) and that taken by a specialist. A specialist CA advisor would be able to further explain the specialist methodology and its benefits.

Will obtaining specialist advice delay the transaction?

In short, no.

Initially a CA specialist will undertake entitlement due diligence to identify whether there is potential for a capital allowances claim and the likely saving. This is purely a desktop exercise, based on the facts of the case. It usually takes no more than two days and is typically free of charge.

Surveying the building is the most time-consuming step but legislation allows 2 years for this to take place following completion. Therefore, provided that the sale and purchase contract makes appropriate provision for the survey and agreement process this should not hold up the transaction.

How much is this likely to cost my client?

Initial reviews are often provided free of charge. As a rough rule of thumb, the cost of surveying the building, agreeing and processing allowance claims is approximately 10 percent of the saving, reducing for higher claims, depending on the amount of the allowance claim.

For case studies see further http://www.lovellconsulting.com/case-studies/ and http://www.lovellconsulting.com/wp/wp-content/uploads/Back-to-Basics.pdf

Learn more at http://www.lovellconsulting.com/2015/04/13/capital-allowances-cpd-breakfast-seminar-10th-june-2015.

John Lovell was interviewed by Melissa Moore.

The views expressed by our interviewees are not necessarily those of the proprietor.

Source: LexisNexis Purpose Built